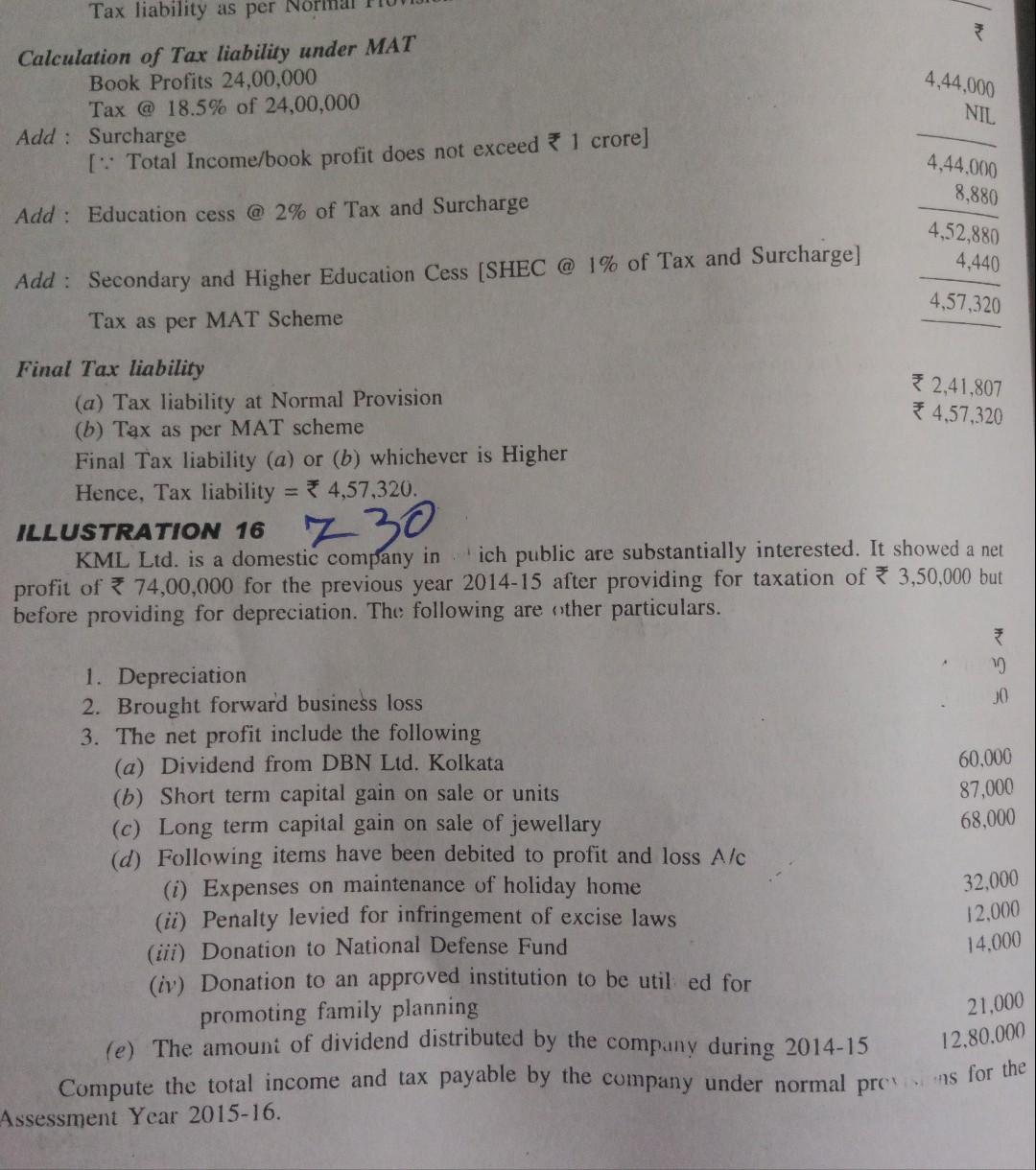

Understand Computation of Book Profit in MAT(115JB) within 6 minutes.Questions solving made easy. - YouTube

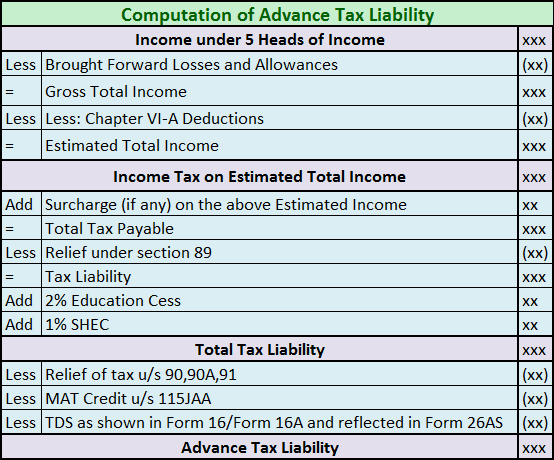

PROMETRICS Finance : Advance Income Tax Liability - Computation based on estimated income less tax deductions and credits

Surcharge and cess is to be calculated after deducting MAT credit u/s 115JAA from tax on assessed income